Purchasing a home is a monumental step, especially for first-time buyers. One of the terms you're likely to encounter during this process is Lenders Mortgage Insurance, better known as LMI. Understanding what LMI is, and when it's required can significantly impact your home buying journey. Let's break down the essentials of Lenders Mortgage Insurance, its cost, and how you might avoid it.

What is Lenders Mortgage Insurance?

Lenders Mortgage Insurance (LMI) is a policy designed to protect the lender from financial loss, if a borrower defaults on their home loan. It’s important to understand that LMI safeguards the lender only, not the borrower. By reducing the lender’s risk, LMI enables lenders to approve home loans for applicants who have less than a 20% deposit.

Lenders view home loans with deposits below 20% as higher risk. If a borrower is unable to meet their repayments and the loan goes into default, the property may need to be sold for less than the remaining loan balance. In this situation, the lender would incur a financial loss.

Here is an example of how LMI covers the lender from financial loss.

If a property has a loan of $450,000, and the property is sold quickly for $420,000, the LMI policy would then repay the lender the difference of the $30,000.

What does Lenders Mortgage Insurance Cost?

The cost of LMI depends on several factors, including your deposit size and the overall loan amount. Lenders calculate the premium using a sliding scale, meaning the lower the deposit, the higher the LMI payable.

Suppose you're buying a property for $500,000 with a deposit of $50,000. Your loan amount would be $450,000, which is 90% of the property's value. In this scenario, you would be required to pay LMI, which could cost several thousand dollars.

The cost of Lenders Mortgage Insurance can range from a few thousand to tens of thousands of dollars, depending on the loan amount and your deposit size.

The premium can be paid upfront or capitalised into the loan, which means it’s added to your total loan amount and repaid over the term of the loan.

Is Lenders Mortgage Insurance Tax Deductible?

For most homebuyers, Lenders Mortgage Insurance is not tax-deductible. However, if you are purchasing an investment property, you may be able to claim LMI as a tax deduction over a period of five years. It's always a good idea to consult with a tax professional to understand how LMI may impact your tax situation.

How To Avoid Lenders Mortgage Insurance?

Avoiding Lenders Mortgage Insurance can save you a significant amount of money. Here are some strategies you might consider:

- The most straightforward way to avoid LMI is to save a 20% deposit. While this may take longer, it will eliminate the need for LMI and reduce your loan amount, potentially lowering your monthly repayments.

- Some lenders offer the option of a guarantor loan, where a family member guarantees a portion of your loan with their property. This can help you avoid LMI by effectively increasing your deposit amount (in equity), but, it also means your guarantor is liable if you default on the loan.

- There are also first-home buyer schemes available to assist buyers in getting into the property market without paying LMI. These schemes might involve government grants or incentives that can boost your deposit.

- In some cases, lenders might waive LMI for certain borrowers, such as medical professionals or high-income earners. It's worth discussing your situation with your mortgage broker to see if you qualify for any exceptions.

How Much Is Lenders Mortgage Insurance?

The cost of Lenders Mortgage Insurance (LMI) varies depending on your deposit size, loan amount, and overall borrower profile. Generally, the smaller your deposit, particularly if it’s under 20%, the higher the LMI premium will be. Lenders calculate LMI on a sliding scale, meaning borrowers with a higher loan-to-value ratio (LVR) typically pay more. For first home buyers, LMI can range from a few thousand dollars to tens of thousands, depending on the property price and borrowing capacity. Using an LMI calculator or speaking with a mortgage broker can help you understand your personalised LMI cost and explore ways to reduce or avoid it.

Calculating Lenders Mortgage Insurance

There is no single formula for calculating Lenders Mortgage Insurance (LMI). Each lender partners with its own mortgage insurer, and these insurers use different calculators, risk assessments, and premium structures to determine the LMI cost for a borrower. This is why working with a mortgage broker can be invaluable. Brokers have access to specialised software that compares LMI premiums across lenders, helping you identify the most cost-effective option for your scenario.

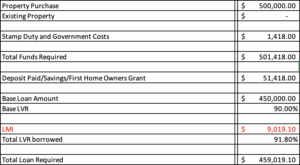

Below is an example of how one lender calculates LMI for a $500,000 property purchase, with a 10% deposit in Victoria as a first home buyer:

As shown in the above example, the LMI premium is $9,019.10. This is a one-off cost that is typically added (or capitalised) onto your total home loan amount and then repaid over the life of the loan. While the figure may initially appear high, spreading it across a 30-year loan term (360 repayments) equates to roughly $25 per month in additional repayments, excluding interest. This demonstrates how LMI can make entering the property market more achievable, even with a smaller deposit.

Understanding Lenders Mortgage Insurance First Home Buyer Requirements

Understanding Lenders Mortgage Insurance for first home buyers is essential when purchasing your first property with a smaller deposit. LMI is generally required when your deposit is less than 20% of the property’s value, as lenders view these loans as higher risk.

As a first home buyer, meeting the criteria for LMI involves providing accurate financial information, demonstrating stable income, and ensuring the property meets lending guidelines. By understanding how LMI works and what lenders look for, you can better prepare for the application process and improve your chances of securing a home loan with a lower upfront deposit.

Conclusion

Lenders Mortgage Insurance is an important factor to consider when buying a home, particularly for first-time buyers with smaller deposits. Understanding when LMI is required and exploring ways to avoid it can help you make informed decisions and potentially save money.

Always consider speaking with a mortgage broker to discuss your options and find the best path for your home-buying journey.

In the end, knowing how LMI works can help you feel more confident when buying a home. It gives you the information you need to make better choices and plan for your future.

Our Reviews

We pride ourselves on being brokers you can actually trust, from the initial consultation through to annual reviews that we perform years after your settlement, our tailored services and relationship focus is built to last.

Need proof that we are one of Melbourne’s best mortgage brokerages? Don’t just take our word for it – we have hundreds of positive Google reviews from real clients so you can rest assured you’re making the right choice with choosing Find A Better Rate Home Loans.

Frequently Asked Questions

Get in Touch

98% Approval Rate

18 Years Experience

18 Years Experience

98% Approval Rate

Latest Articles from Find A Better Rate

-

Aussie home owners just got $82,000 richer on average

What a way to start the new year! After a strong 12 months in the property market, plenty of homeowners around the nation are now a whole lot wealthier. And their newfound increase in home equity has opened up some exciting possibilities for 2026. Your home isn’t just a place to live in, it could…

-

Happy New Year! Let’s discuss some potential 2026 goals

There’s nothing quite like a New Year’s resolution to fire you up for another lap around the sun. Whether you’re looking to buy your first home, save on your mortgage, or leverage the equity in your current position, here are three resolutions to consider for 2026. So long, 2025 … You know what? We’ve got…

-

Season’s greetings! Here’s to a well-earned summer break

As the Christmas and New Year’s festive season rolls around, we want to take a moment to sincerely thank you for your trust and support throughout 2025. Fortunately, we had a bit more to smile about this year, with three RBA rate cuts and national property prices increasing by 8.7%. That said, 2025 wasn’t without its…

-

Aussie home owners just got $82,000 richer on average

What a way to start the new year! After a strong 12 months in the property market, plenty of homeowners around the nation are now a whole lot wealthier. And their newfound increase in home equity has opened up some exciting possibilities for 2026. Your home isn’t just a place to live in, it could…

-

Happy New Year! Let’s discuss some potential 2026 goals

There’s nothing quite like a New Year’s resolution to fire you up for another lap around the sun. Whether you’re looking to buy your first home, save on your mortgage, or leverage the equity in your current position, here are three resolutions to consider for 2026. So long, 2025 … You know what? We’ve got…

-

Season’s greetings! Here’s to a well-earned summer break

As the Christmas and New Year’s festive season rolls around, we want to take a moment to sincerely thank you for your trust and support throughout 2025. Fortunately, we had a bit more to smile about this year, with three RBA rate cuts and national property prices increasing by 8.7%. That said, 2025 wasn’t without its…

-

Your suburb’s 2025 property report card is in

You might’ve seen recent headlines that national property prices made another big jump this year. But do you know exactly how your suburb and property type performed? Well, today we’ll show you how to find out in just a few quick clicks. Over the past year, home prices have risen 8.7% nationally, according to PropTrack. If…

-

Aussie home owners just got $82,000 richer on average

What a way to start the new year! After a strong 12 months in the property market, plenty of homeowners around the nation are now a whole lot wealthier. And their newfound increase in home equity has opened up some exciting possibilities for 2026. Your home isn’t just a place to live in, it could…

-

Happy New Year! Let’s discuss some potential 2026 goals

There’s nothing quite like a New Year’s resolution to fire you up for another lap around the sun. Whether you’re looking to buy your first home, save on your mortgage, or leverage the equity in your current position, here are three resolutions to consider for 2026. So long, 2025 … You know what? We’ve got…